Mobilink Bank, a leader in digital financial services, launched its sustainability program, “Change to Sustain,” signaling a step forward in its journey towards operational transformation and promoting environmental stewardship within the banking sector.

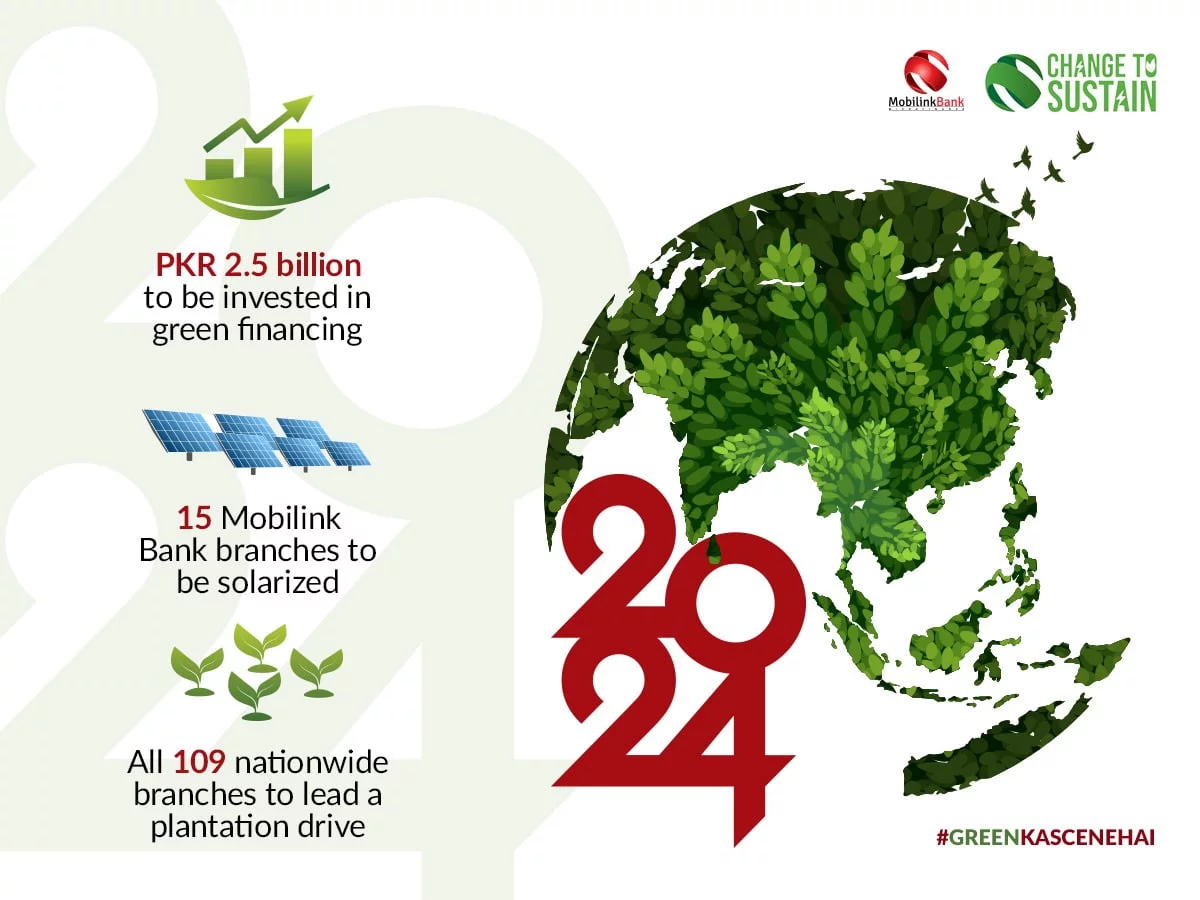

Fueling this initiative is the strategic allocation of PKR 2.5 billion towards renewable energy financing. Embedded with its sustainability strategy, fifteen (15) Mobilink Bank branches are slated to undergo solarization, harnessing solar energy and reducing carbon emissions. Across all 109 nationwide branches, the Bank will also spearhead a large-scale tree plantation drive, contributing to preserving local ecosystems and biodiversity.

VEON is a global digital operator that provides converged connectivity and digital services to nearly 160 million customers in six dynamic markets that are home to 7% of world’s population.

The “Change to Sustain” initiative is a concerted effort to drive sustainability practices by integrating Environmental, Social and Governance (ESG) principles into the Bank’s operations. The initiative strives to promote green business practices, advocate for climate action, raise awareness about sustainability issues, empower women-led climate resilience solutions, expand access to green financing and encourage the adoption of renewable energy solutions.

“At Mobilink Bank, we see the winds of change as an opportunity to drive positive transformation. The ‘Change to Sustain’ initiative reflects our efforts to align the Bank with ESG principles for a future where progress and sustainability go hand in hand,” shared Haaris Mahmood Chaudhary, Chief Operating Officer (COO) Mobilink Bank. “Every action we take is driven by a deep commitment to minimizing our environmental footprint, empowering unbanked individuals, catalyzing positive social change and supporting the advancement of small businesses nationwide.

Recognizing the pivotal role of microfinance institutions in realizing the UN’s Sustainable Development Goals, we are steadfast in harnessing our capabilities and resources to foster eco-friendly financing for individuals and small-scale businesses, with a particular focus on those led by women. We believe that supporting small businesses and female entrepreneurs can yield enduring benefits for both the environment and society at large,” he added.

Mobilink Bank spearheads green financing by actively supporting individuals, particularly women, to address climate challenges while seamlessly incorporating sustainability into its operations. Through impactful initiatives like “Change to Sustain” and the Women Inspirational Network (WIN) program, the Bank empowers its borrowers with the necessary tools and resources to adapt and build resilience against climate change. The Bank also offers accessible green financing solutions, including solar financing, to ensure that sustainability is attainable for all.

Amid mounting regional tensions and the reported closure of the Strait of Hormuz, Pakistan’s energy…

U.S. military leaders highlighted steady progress in their campaign against Iran on Wednesday as they…

Turkish officials confirmed that NATO's air defenses neutralized a ballistic missile from Iran as it…

On Wednesday, David and Victoria Beckham sent a heartfelt message to their estranged son, Brooklyn…

The United States military has recently attacked more than 1,000 targets in Iran, culminating in…

Novo Nordisk and the Ministry of National Health Services, Regulations and Coordination (MoNHSRC) marked World…

This website uses cookies.