Pakistan’s caretaker IT Minister, Umar Saif, announced a partnership between Payoneer and PayPal, suggesting PayPal’s indirect entry into the Pakistani market. However, reliable sources have contradicted this claim, emphasizing that the collaboration doesn’t signify PayPal launching operations in Pakistan.

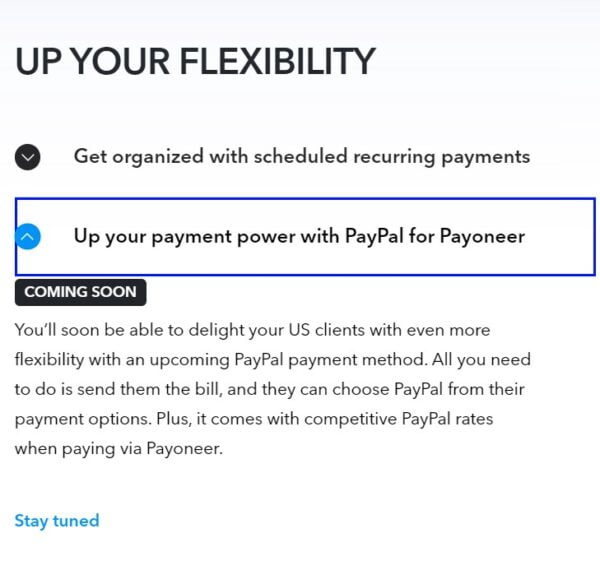

According to insider information, Payoneer is forming a partnership with PayPal to incorporate PayPal as a payment method for Payoneer users. For instance, businesses in the United States outsourcing work to freelancers in Pakistan can use Payoneer to make payments, including through PayPal, akin to credit or debit card transactions.

The existing restriction for Pakistani users remains, preventing them from directly creating PayPal accounts from Pakistan. This restriction persists even with the Payoneer partnership, emphasizing that Pakistani users cannot open PayPal accounts directly or through Payoneer.

The partnership isn’t exclusive to Pakistan and extends globally across all regions where Payoneer operates. Sources said that the minister’s attempt to make the partnership Pakistan-specific might hinder the nation’s efforts to bring PayPal into the country.

The prospect of introducing PayPal to Pakistan has been a focal point in IT policy discussions due to escalating demands from freelancers. Pakistan, recognized as one of the fastest-growing markets for freelancers globally, ranks fourth in terms of freelancer numbers. In September of the previous year, Minister Umar Saif expressed active efforts to bring PayPal and Stripe to Pakistan, but no significant progress has been made since.

A study by the Pakistan Institute of Development Economics (PIDE) indicates that PayPal’s reluctance to operate in Pakistan could be attributed to perceived constraints linked to electronic money institutions (EMIs) licensing, concerns about money laundering, and restrictions imposed by the Financial Action Task Force (FATF) on Pakistan. Exchange control regulations and data privacy are cited as additional obstacles preventing PayPal’s entry into the Pakistani market.