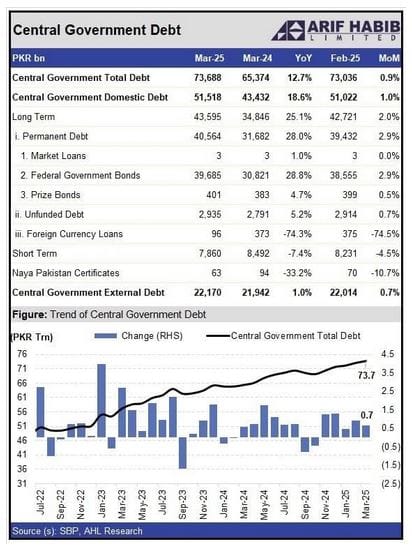

The State Bank of Pakistan has reported a sharp rise in the federal government’s debt, igniting fresh concerns over the country’s financial resilience. According to the central bank’s latest data, total government debt rose to Rs. 73.69 trillion by March 2025—a 12.7% increase compared to Rs. 65.38 trillion recorded in March 2024.

Month-on-month figures also reflect a troubling pattern, with debt swelling by 0.9%—or Rs. 652 billion—in just one month.

The report highlights a notable surge in domestic borrowing, which climbed by 18.6%, from Rs. 43.43 trillion to Rs. 51.52 trillion over the year. External debt also saw a modest uptick, growing by 0.7% in a single month and 1% annually to reach Rs. 22.17 trillion.

The central bank noted a marked shift towards long-term borrowing, while short-term debt saw a marginal decline.

Economists warn that Pakistan’s persistent reliance on borrowing is compounding its fiscal challenges. Experts point to the widening budget deficit and warn that continued dependence on loans is making debt repayment increasingly difficult.

Analysts have called for urgent fiscal reforms to address structural imbalances and reduce the growing pressure on the public purse.